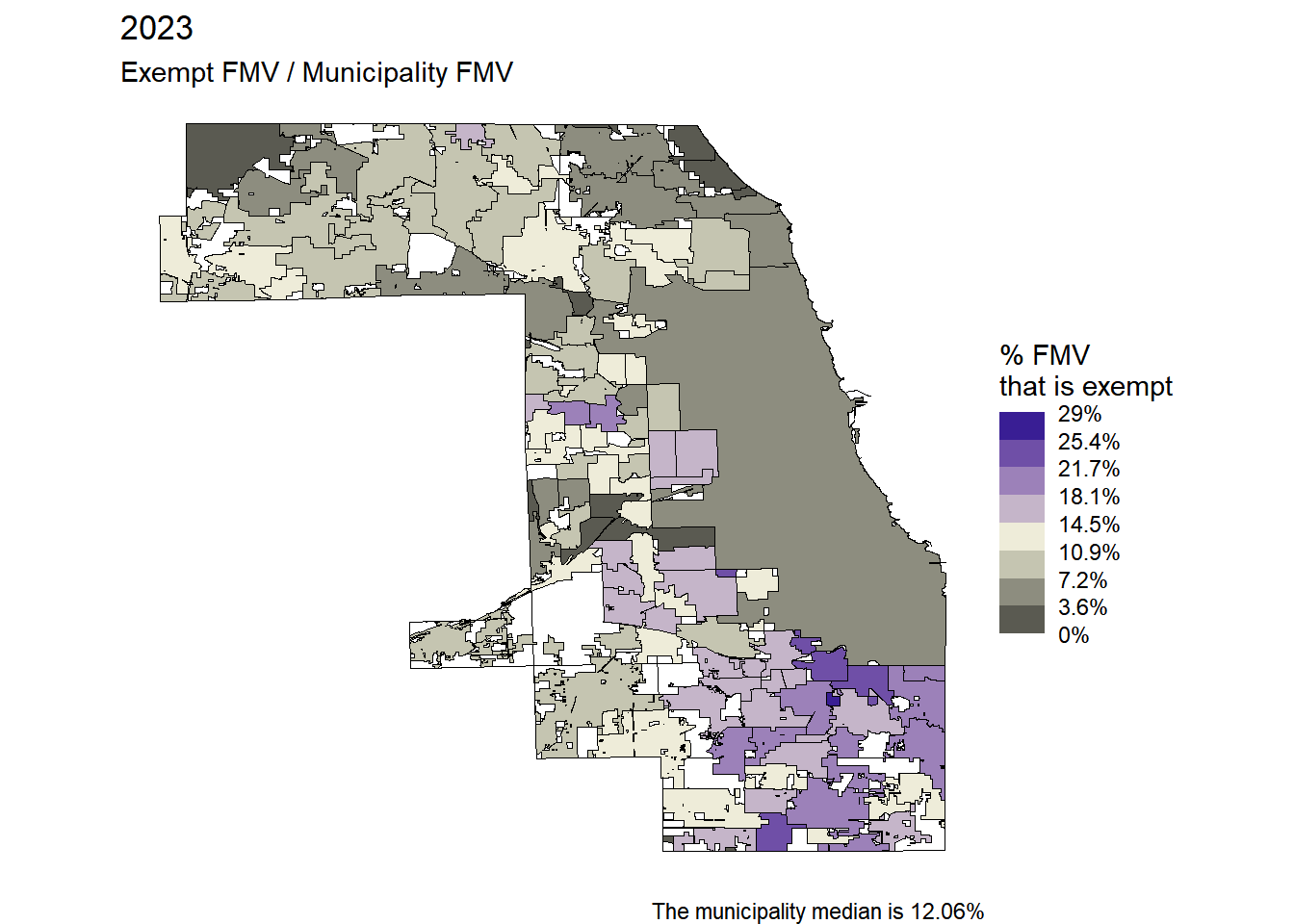

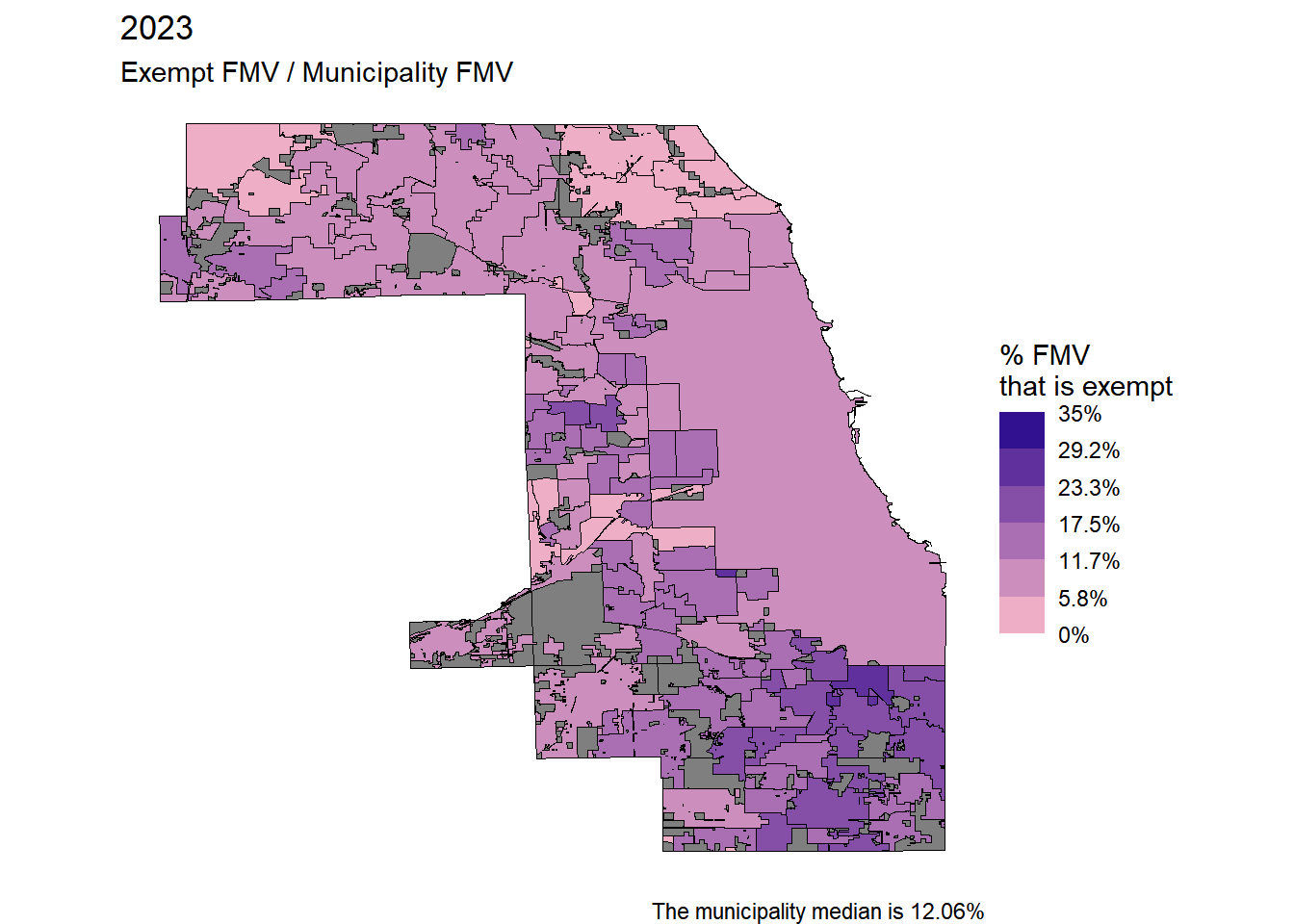

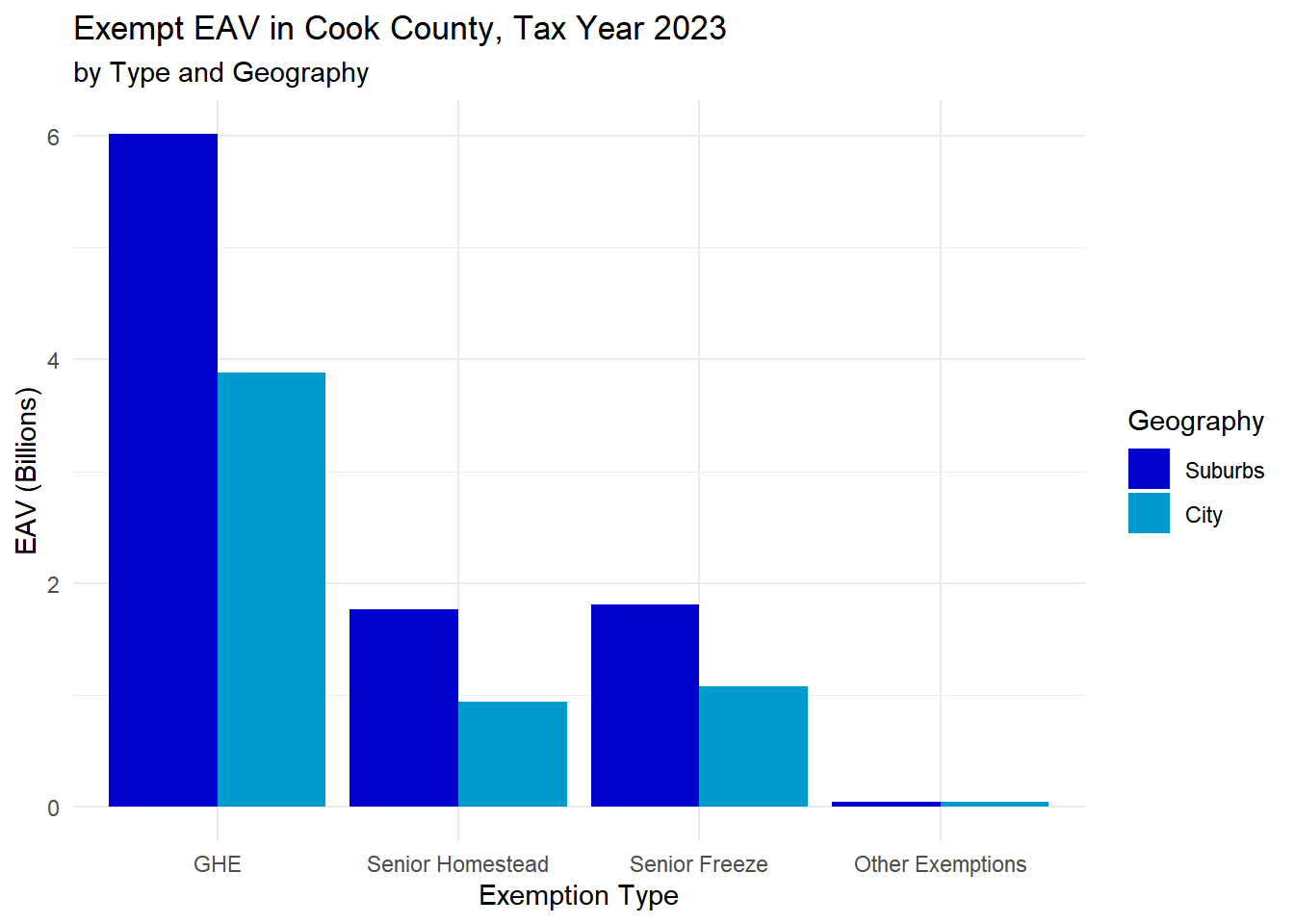

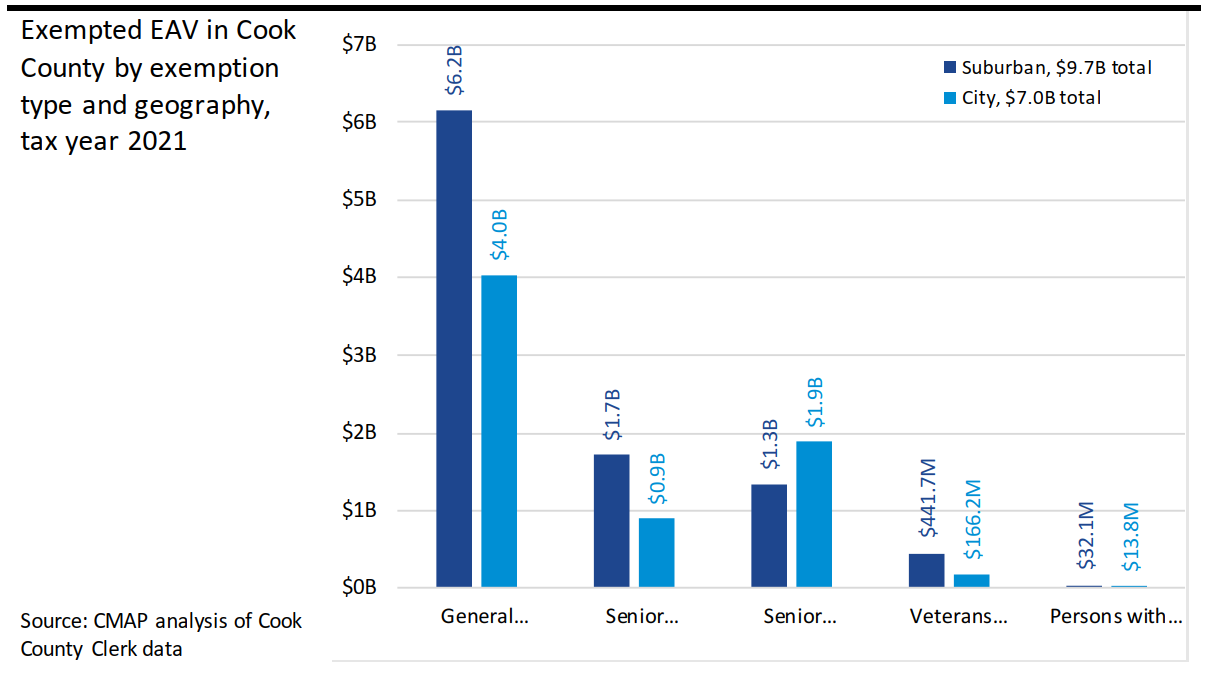

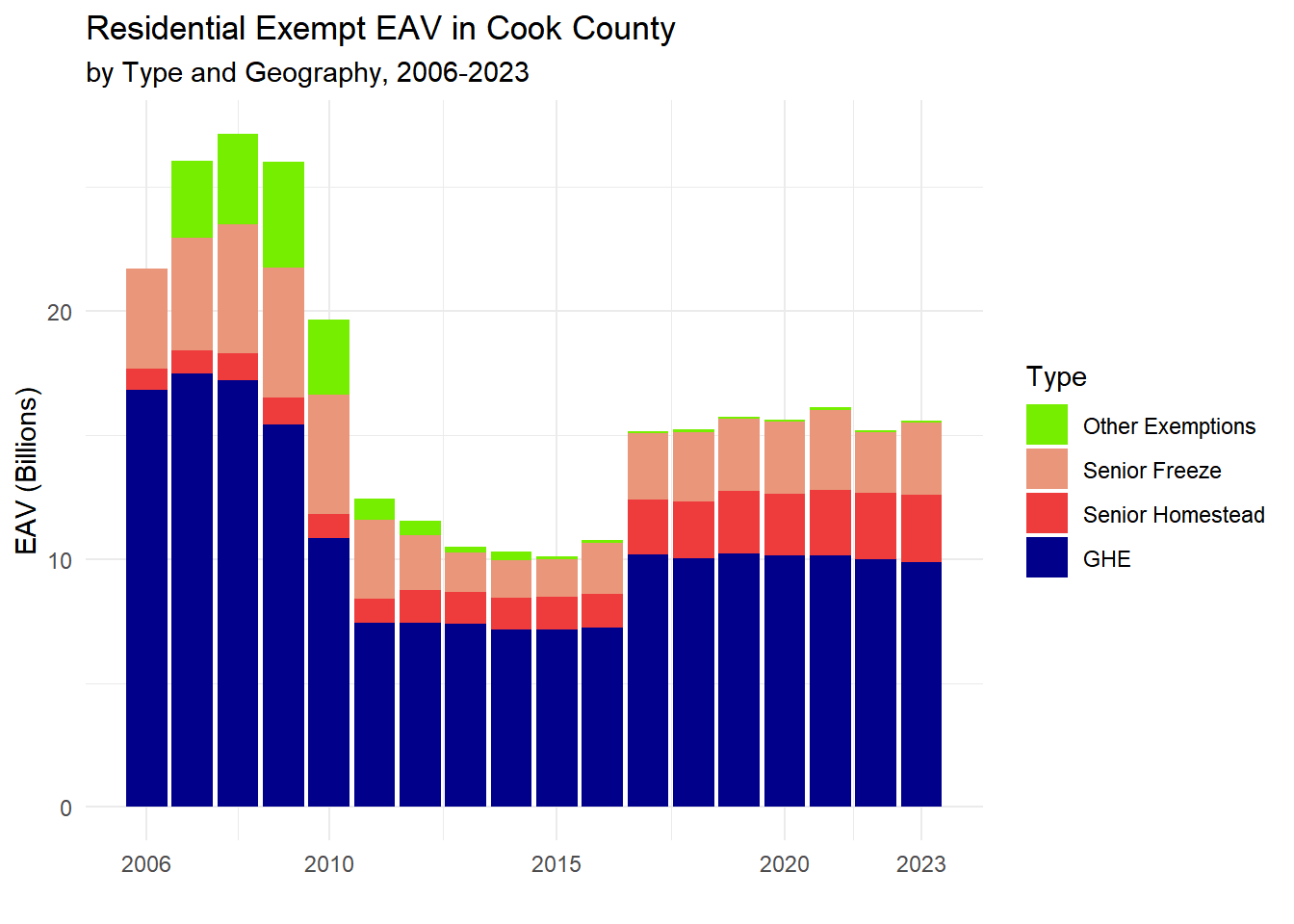

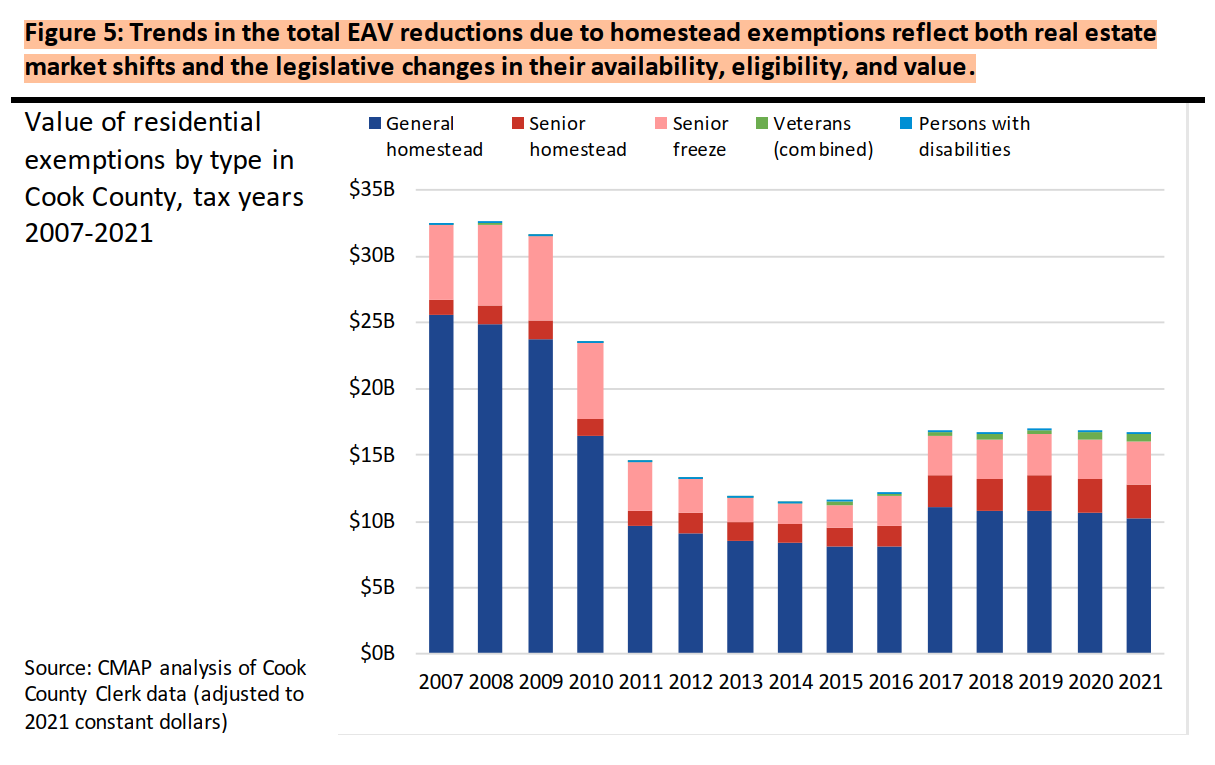

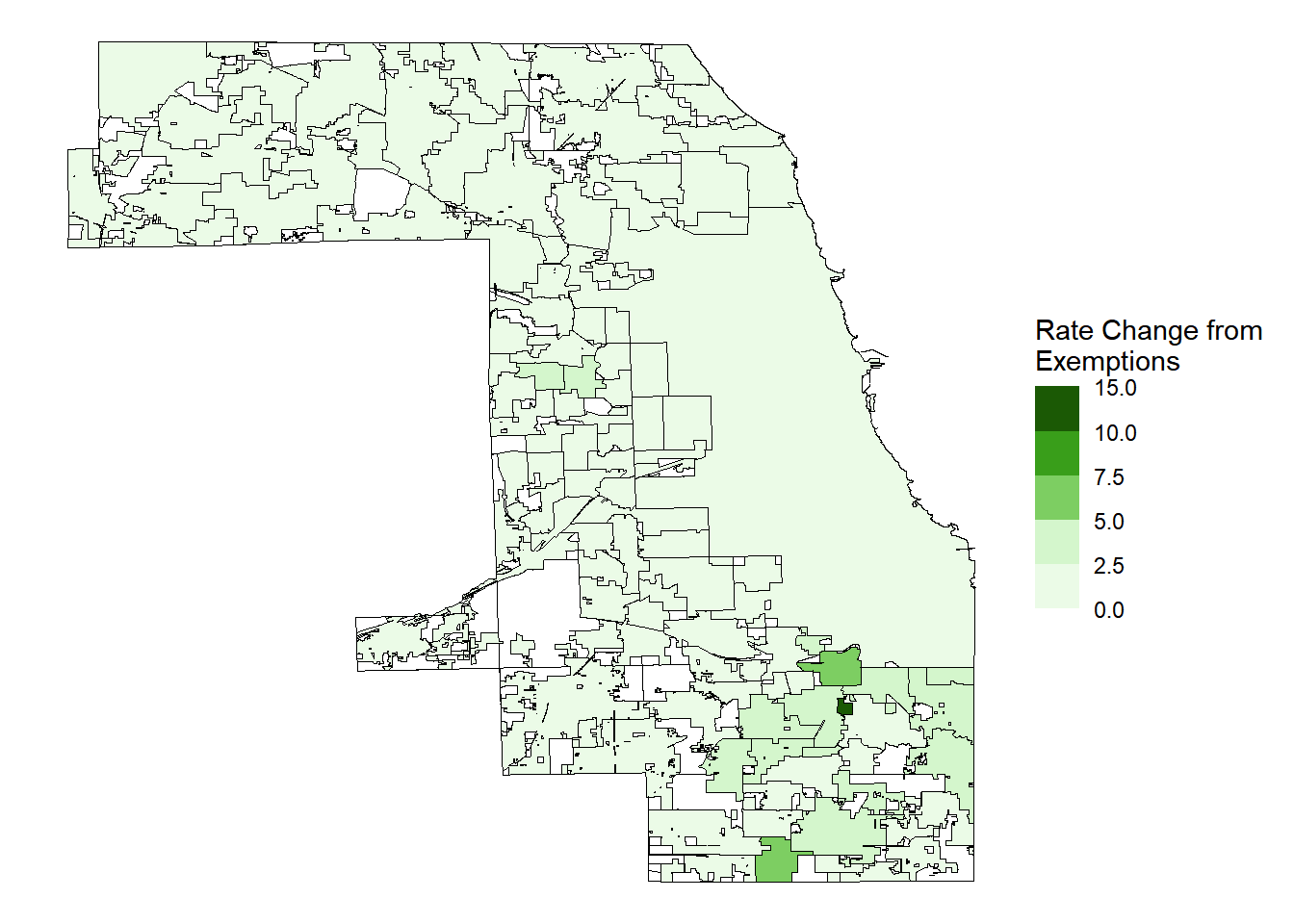

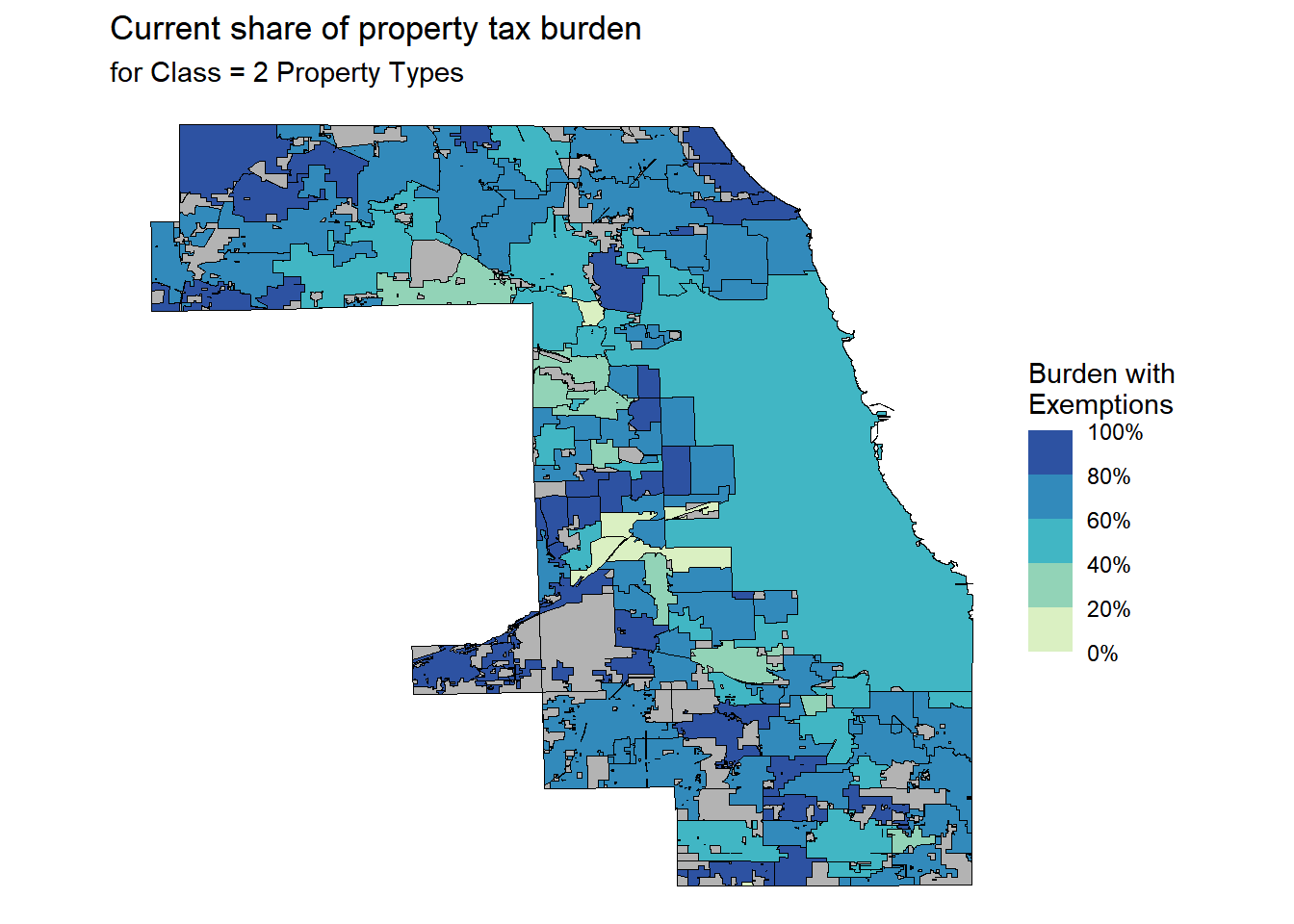

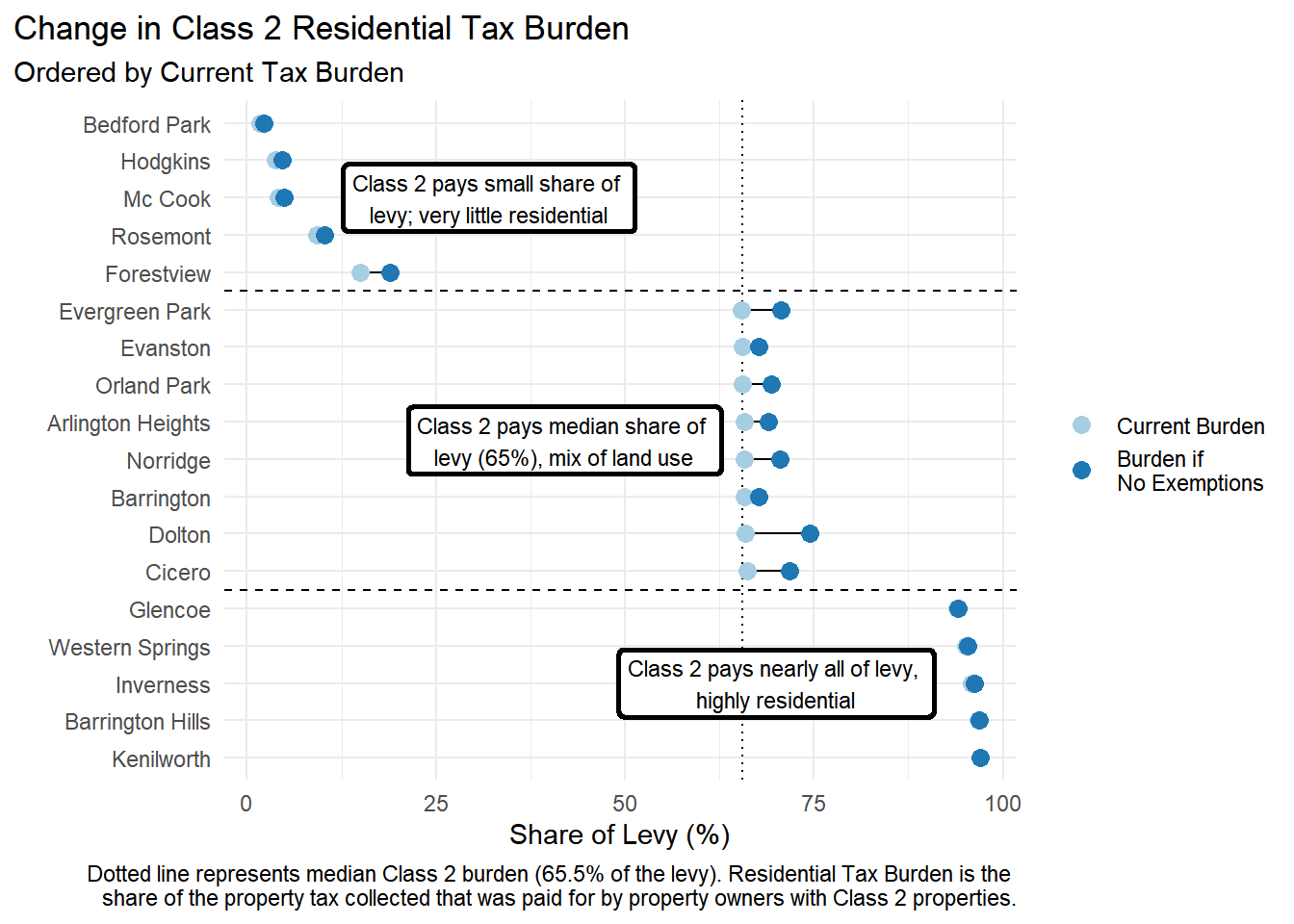

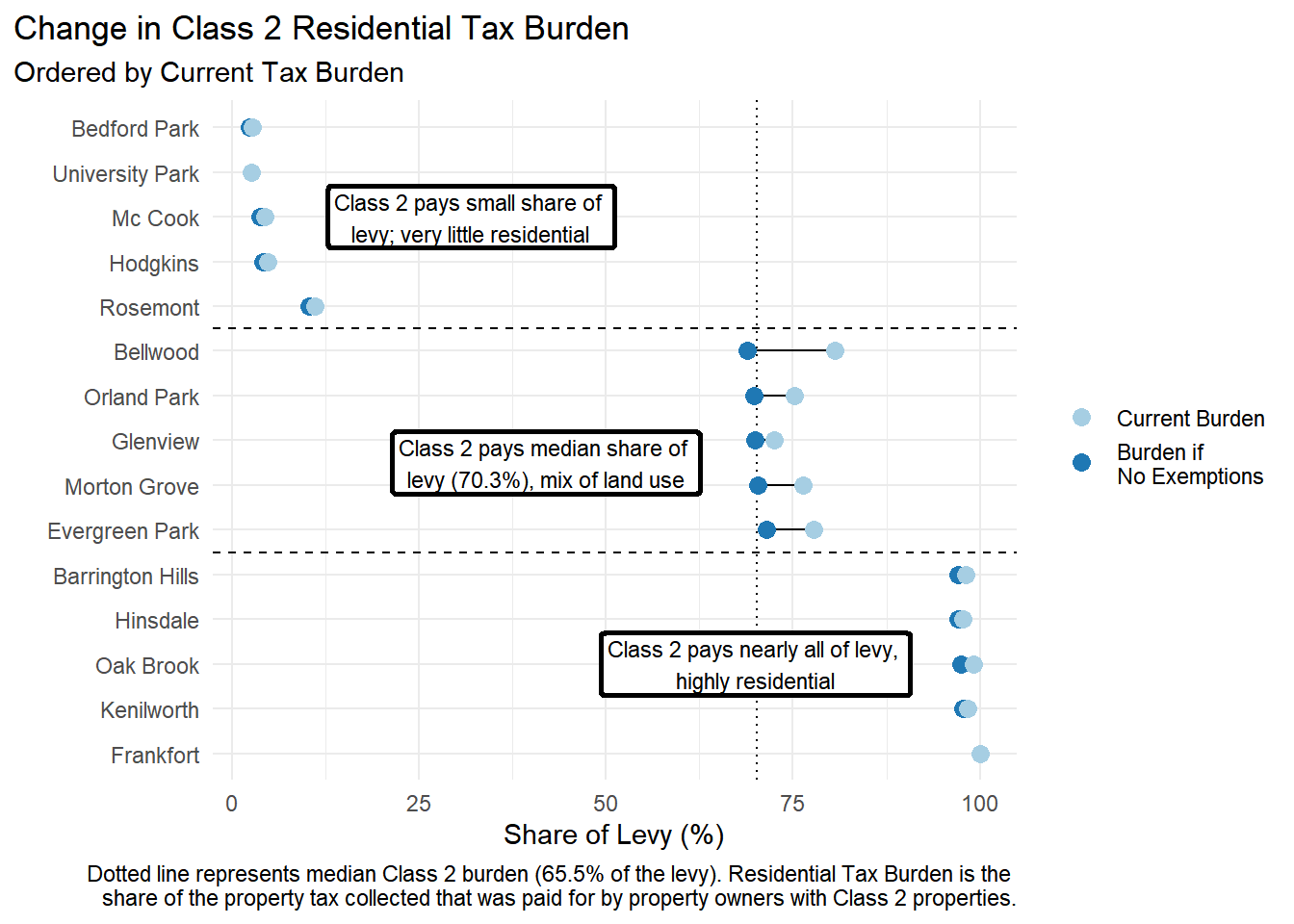

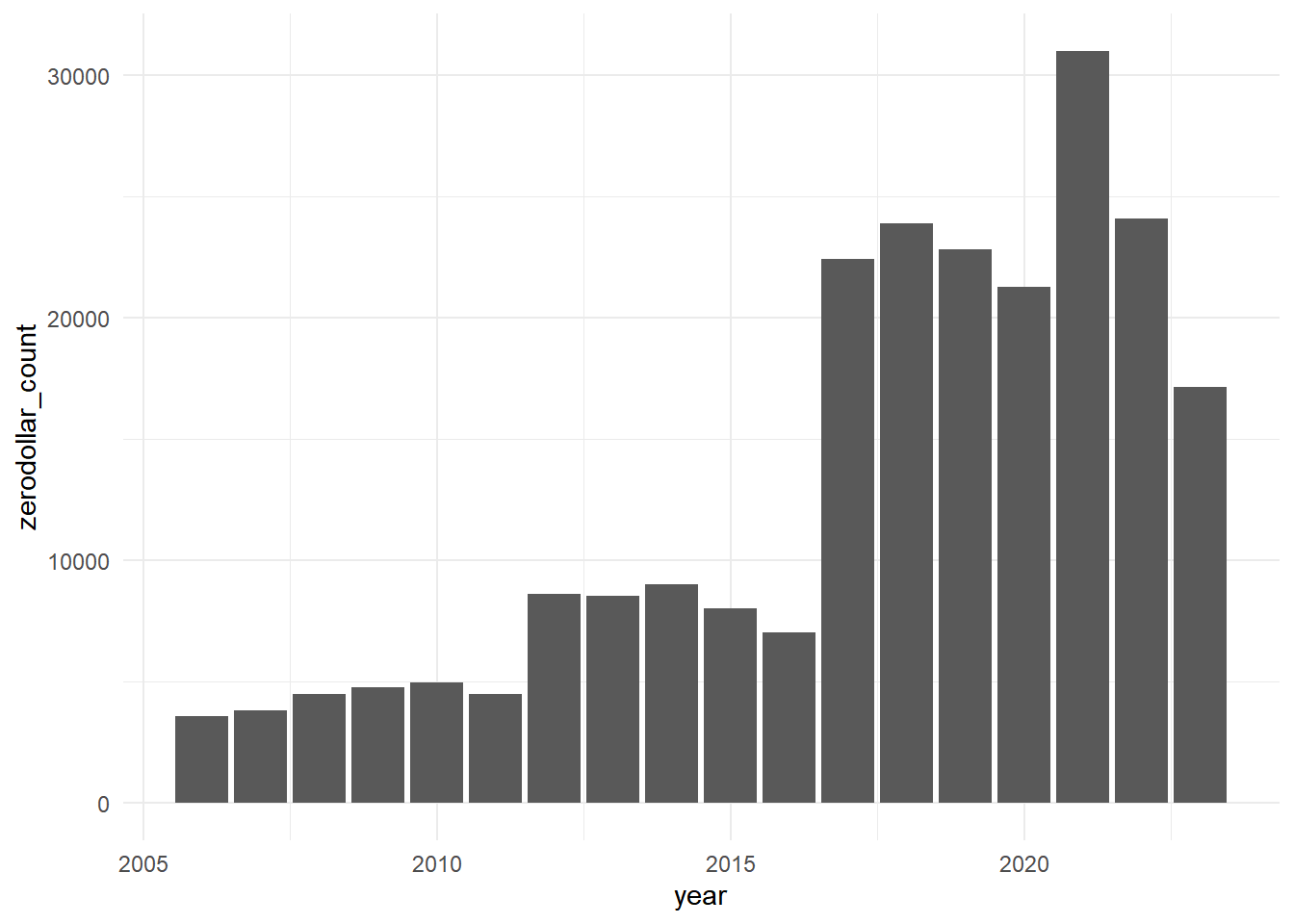

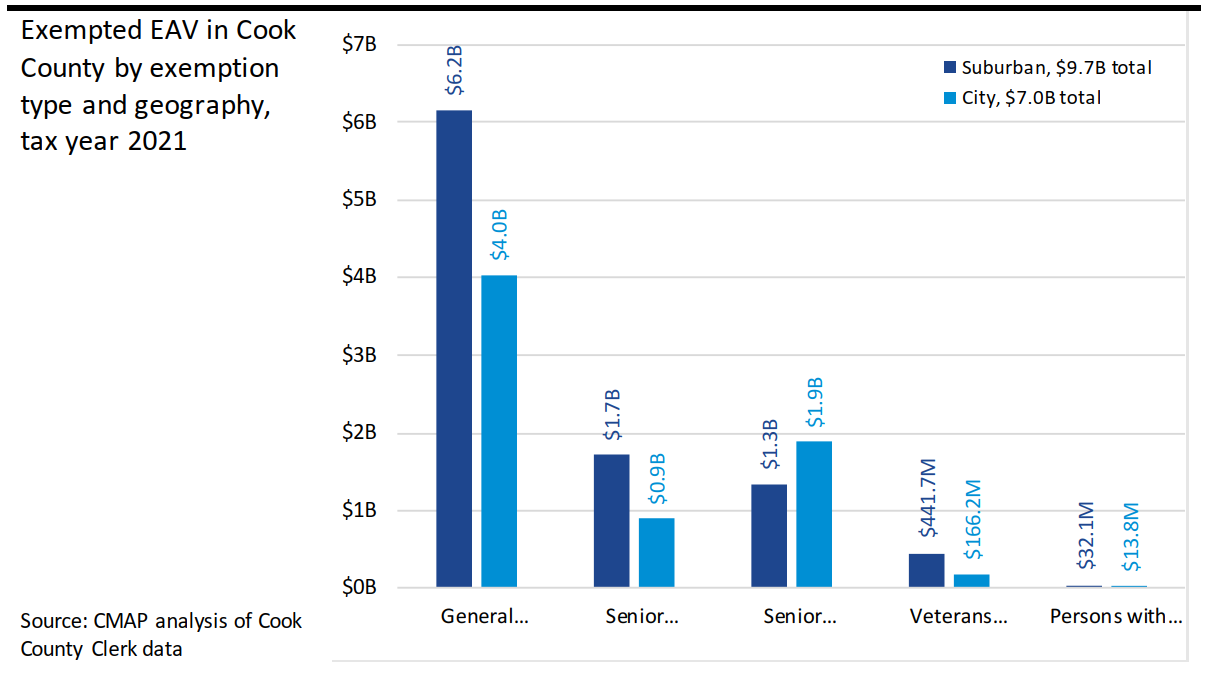

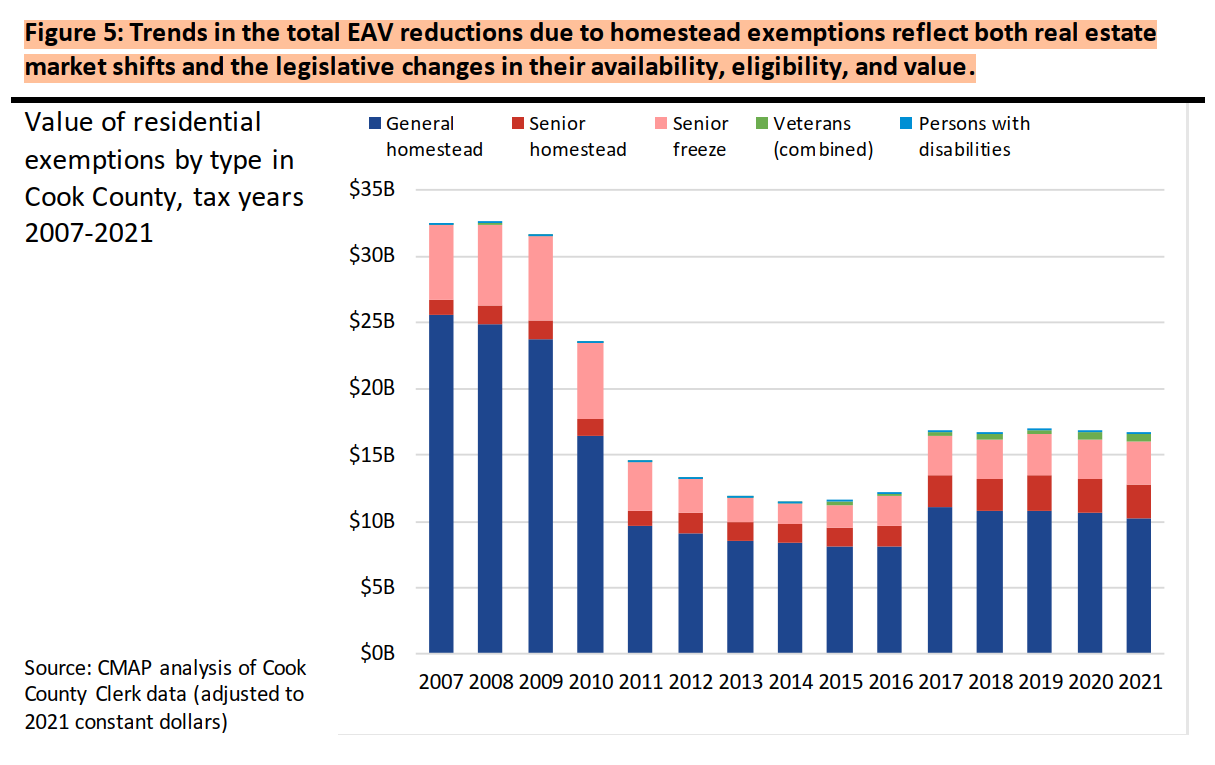

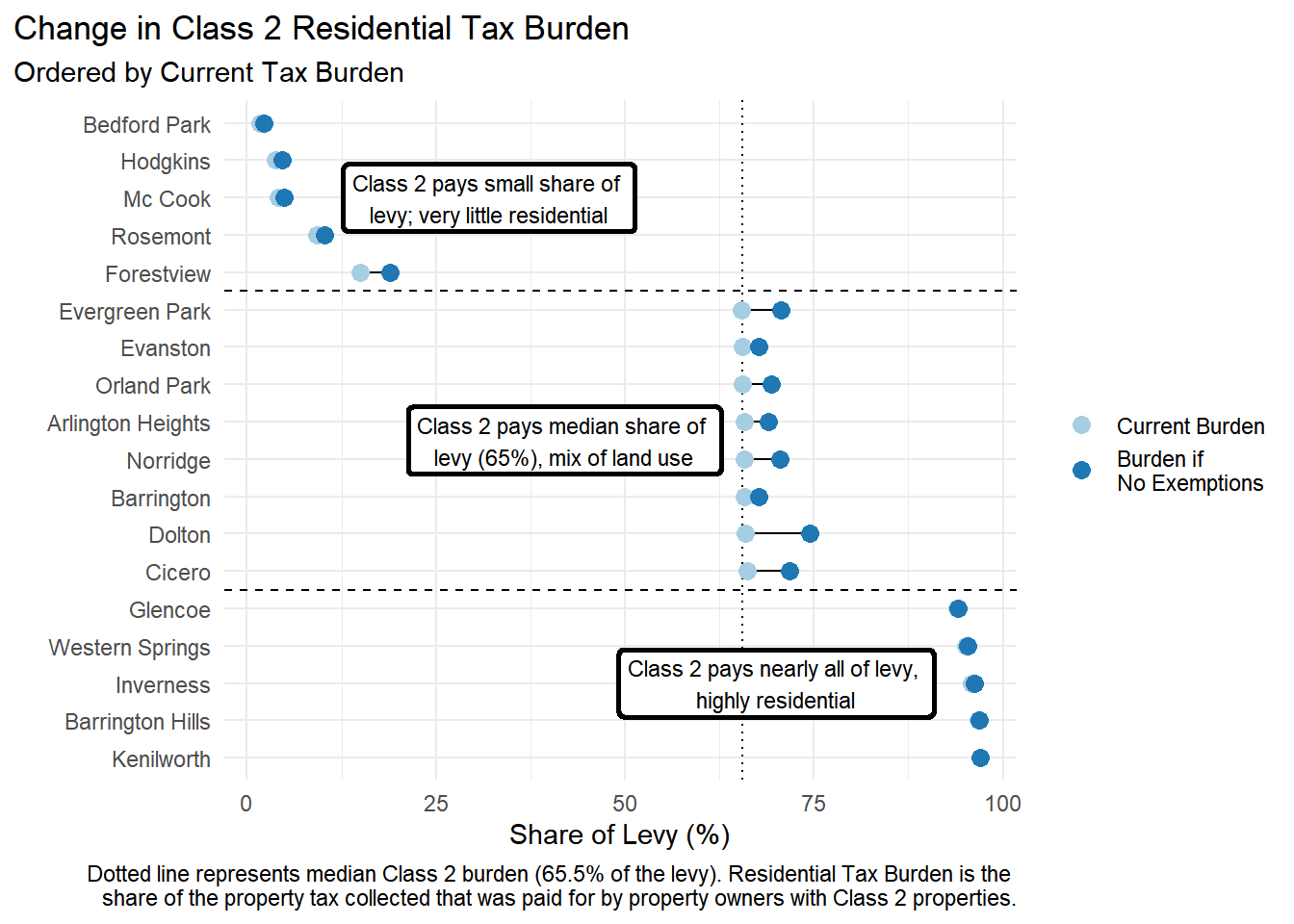

--- title: "Exemptions in Cook County - Tax Year 2023" format: html: code-fold: true toc: true toc-location: left tbl-cap-location: margin fig-cap-location: margin df-print: paged --- ```{r setup} #| output: false library(tidyverse) #library(ptaxsim) #library(DBI) library(httr) library(jsonlite) library(glue) library(sf) library(DT) library(flextable) knitr::opts_chunk$set(warning = FALSE, message = FALSE) options(scipen = 999) muni_shp <- read_sf("https://gis.cookcountyil.gov/traditional/rest/services/politicalBoundary/MapServer/2/query?outFields=*&where=1%3D1&f=geojson") nicknames <- readxl::read_excel("../Necessary_Files/muni_shortnames.xlsx") ``` ## Cook County's Use of Homestead Exemptions ### Figure 1 or 2?. Exemption Use ```{r} <- read_csv ("../Output/ptaxsim_muni_level_2006to2023.csv" ) |> left_join (nicknames)<- read_csv ("../Output/ptaxsim_muni_MC_2006to2023.csv" ) |> rename_all (~ str_replace (., "muni_mc_" , "" ))<- read_csv ("../Output/ptaxsim_muni_class_summaries_2006to2023.csv" ) |> left_join (nicknames)``` ```{r} <- c (2023 )for (i in year_examples){<- muni_cl_sums %>% filter (year == i) %>% group_by (year) %>% summarize (AV = sum (muni_c_av), EAV = sum (muni_c_eav), Eq_AV = sum (muni_c_equalized_av),'Taxed EAV' = sum (muni_c_current_taxable_eav),'All Exemptions' = sum (muni_c_all_exemptions), 'GHE' = sum (muni_c_exe_homeowner), 'Senior Exemp.' = sum (muni_c_exe_senior), 'Freeze Exemp.' = sum (muni_c_exe_freeze), 'PINs in Muni' = sum (muni_c_pins_in_muni),'PINs with Exemptions' = sum (muni_c_has_HO_exemp)) %>% pivot_longer (cols = c (AV: 'PINs with Exemptions' ), names_to = "Totals" , values_to = "Values" ) print (tbl)``` ### Figure 3. Percent Exempt ```{r} <- c (2023 )for (i in year_examples){<- muni_sums %>% filter (year== i)%>% mutate (pct_fmv_exempt = muni_fmv_exempt / muni_fmv%>% select (pct_fmv_exempt)= scales:: percent (median (median_exempt$ pct_fmv_exempt), accuracy = 0.01 )print (muni_sums %>% filter (year== i)%>% mutate (pct_fmv_exempt = muni_fmv_exempt / muni_fmv ) %>% mutate (agency_name = ifelse (agency_name == "TOWN CICERO" , "CITY OF CICERO" , agency_name) ) %>% full_join (muni_shp, by = c ("agency_name" = "AGENCY_DESC" )) %>% ggplot (aes (fill = pct_fmv_exempt)) + geom_sf (aes (geometry = geometry), color = "black" ) + theme_void ()+ labs (title = paste0 (i), subtitle = "Exempt FMV / Municipality FMV" ,caption = sprintf ("The municipality median is %s" , midpoint)) + theme_void () + theme (axis.ticks = element_blank (), axis.text = element_blank ())+ scale_fill_steps2 (high = "darkblue" , low = "black" , mid = "beige" ,n.breaks = 7 , show.limits= TRUE ,na.value = NA ,nice.breaks = FALSE ,midpoint = median (median_exempt$ pct_fmv_exempt),name = "% FMV \n that is exempt" , label = scales:: percent))``` ```{r} <- c (2023 )for (i in year_examples){<- muni_sums %>% filter (year== i)%>% mutate (pct_fmv_exempt = muni_fmv_exempt / muni_fmv%>% select (pct_fmv_exempt)= scales:: percent (median (median_exempt$ pct_fmv_exempt), accuracy = 0.01 )print (muni_sums %>% filter (year== i)%>% mutate (pct_fmv_exempt = muni_fmv_exempt / muni_fmv ) %>% mutate (agency_name = ifelse (agency_name == "TOWN CICERO" , "CITY OF CICERO" , agency_name) ) %>% full_join (muni_shp, by = c ("agency_name" = "AGENCY_DESC" )) %>% ggplot (aes (fill = pct_fmv_exempt)) + geom_sf (aes (geometry = geometry), color = "black" ) + theme_void ()+ labs (title = paste0 (i), subtitle = "Exempt FMV / Municipality FMV" ,caption = sprintf ("The municipality median is %s" , midpoint)) + theme_void () + theme (axis.ticks = element_blank (), axis.text = element_blank ())+ scale_fill_steps (high = "darkblue" , low = "pink" ,n.breaks = 5 , show.limits= TRUE ,limits = c (0 , 0.35 ),na.value = "gray50" ,nice.breaks = FALSE ,name = "% FMV \n that is exempt" , label = scales:: percent))``` ### Figure 4. Exempt Tax Base in Cook County ```{r} #| label: tbl-exemptiontotals_for2023 #| tbl-cap: "Total Exempt EAV in 2023 in the City of Chicago and the Suburbs" #| caption: "Note: Our current calculations undervalue the disabled veterans exemption." %>% filter (year == 2023 ) %>% select (clean_name, muni_c_exe_homeowner: muni_c_exe_vet_dis) %>% mutate (clean_name = ifelse (is.na (clean_name), "Unincorporated" , clean_name),Geography = ifelse (clean_name == "Chicago" , "City" , "Suburbs" ),Geography = ifelse (is.na (clean_name), "Unincorporated" , Geography),Geography = factor (Geography, levels = c ("Suburbs" , "City" , "Unincorporated" ))) %>% group_by (Geography) %>% summarize ("GHE" = sum (muni_c_exe_homeowner, na.rm= TRUE ),"Senior Homestead" = sum (muni_c_exe_senior, na.rm= TRUE ),"Senior Freeze" = sum (muni_c_exe_freeze, na.rm= TRUE ),"Other Exemptions" = sum (muni_c_exe_longtime_homeowner+ muni_c_exe_disabled+ muni_c_exe_vet_returning+ muni_c_exe_vet_dis_lt50 + muni_c_exe_vet_dis_50_69+ muni_c_exe_vet_dis_ge70)) %>% pivot_longer (cols = c (` GHE ` : ` Other Exemptions ` ), names_to = "Type" ) %>% mutate (Type = factor (Type, levels = c ("GHE" , "Senior Homestead" , "Senior Freeze" , "Other Exemptions" #"Senior Freeze", "Senior Homestead", "GHE" %>% ggplot (aes (x= Type, y = value/ 1000000000 , fill = Geography+ geom_col (position = "dodge" + theme_minimal () + labs (title = "Exempt EAV in Cook County, Tax Year 2023" , subtitle = "by Type and Geography" , y = "EAV (Billions)" , x = "Exemption Type" ) + scale_y_continuous () + scale_fill_manual (values = c ("blue3" , "deepskyblue3" , "gray" ), )```  ### Figure 5. Value of residential exemptions by type in Cook County, 2006 - 2023 ```{r} %>% select (year, muni_c_exe_homeowner: muni_c_exe_vet_dis) %>% group_by (year) %>% summarize ("GHE" = sum (muni_c_exe_homeowner, na.rm= TRUE ),"Senior Homestead" = sum (muni_c_exe_senior, na.rm= TRUE ),"Senior Freeze" = sum (muni_c_exe_freeze, na.rm= TRUE ),"Other Exemptions" = sum (muni_c_exe_longtime_homeowner + muni_c_exe_disabled + muni_c_exe_vet_returning+ muni_c_exe_vet_dis_lt50 + muni_c_exe_vet_dis_50_69+ muni_c_exe_vet_dis_ge70, na.rm = T)) %>% pivot_longer (cols = c (` GHE ` : ` Other Exemptions ` ), names_to = "Type" ) %>% mutate (Type = factor (Type, levels = c (#"GHE", "Senior Homestead", "Senior Freeze", "Other Exemptions" , "Senior Freeze" , "Senior Homestead" , "GHE" ))) %>% ggplot (aes (x= year, y = value/ 1000000000 , fill = Type)) + geom_bar ( stat = "identity" ) + theme_minimal () + labs (title = "Residential Exempt EAV in Cook County" , subtitle = "by Type and Geography, 2006-2023" , y = "EAV (Billions)" , x = "" ) + scale_fill_manual (values = c ("chartreuse2" , "darksalmon" , "brown2" , "blue4" )) + scale_x_continuous (breaks = c (2006 , 2010 , 2015 , 2020 , 2023 ))```  ## Effect on Composite Tax Rates <!--- Do not use the eq_av variable from the joined pins csv. Delete or correct ASAP. ---> ```{r} #| label: recode-ptaxpins <- c ("030440000" , "030585000" , "030890000" , "030320000" , "031280000" ,"030080000" , "030560000" , "031120000" , "030280000" , "030340000" ,"030150000" ,"030050000" , "030180000" ,"030500000" , "031210000" )<- 3.02 <- c ("6" , "7A" , "7B" , "8A" , "8B" )<- c (401 : 435 , 490 , 491 , 492 , 496 : 499 ,500 : 535 ,590 , 591 , 592 , 597 : 599 , 700 : 799 ,800 : 835 , 891 , 892 , 897 , 899 ) <- c (480 : 489 ,493 , 550 : 589 , 593 ,600 : 699 ,850 : 890 , 893 <- read_csv ("../Output/Dont_Upload/0_Joined_PIN_data_2023.csv" ) %>% select (- c (eq_av, propclass_1dig))<- ptax_pins %>% mutate (class_1dig = str_sub (class, 1 ,1 ),class_group = case_when (== 5 & class %in% commercial_classes) ~ "5A" ,== 5 & class %in% industrial_classes) ~ "5B" ,== 7 & class < 742 ~ "7A" ,== 7 & class >= 742 ~ "7B" ,== 8 & class %in% commercial_classes ) ~ "8A" ,== 8 & class %in% industrial_classes ) ~ "8B" ,TRUE ~ as.character (class_1dig))) %>% mutate (# taxing district revenue = taxable eav * tax rate so rearrange the formula: taxed_eav = final_tax_to_dist / tax_code_rate* 100 ,total_value_eav = (final_tax_to_dist + final_tax_to_tif)/ tax_code_rate * 100 + all_exemptions + abatements,exempt_eav_inTIF = ifelse (in_tif == 1 , all_exemptions, 0 ),exempt_eav = all_exemptions + abatements,taxed_av = taxed_eav / eq_factor, # current value that taxing agencies can tax for their levies ## taxable AV = equalized assessed value net TIF increments, gross exemptions. ## Used for calculating untaxable value further below # taxable_av = (final_tax_to_dist / tax_code_rate *100 + all_exemptions + abatements)/ eq_factor, # taxable_eav_fromincents = ifelse(class >=600 & class < 900, taxable_av * eq_factor, 0), ## untaxable value = exempt EAV from abatements and exemptions + TIF increment untaxable_value_eav = all_exemptions + abatements + ## TIF increment EAV above frozen EAV, which becomes TIF revenue / tax_code_rate* 100 ) + ## difference between 25% and reduced level of assessment for incentive class properties. Excludes TIF increment when calculating the difference! ifelse (between (class, 600 , 899 ), / loa* 0.25 - taxed_av)* eq_factor, 0 ),untaxable_incent_eav = ifelse (between (class, 600 , 899 ), / loa* 0.25 - taxed_av)* eq_factor, 0 ),# manually adjust untaxable value of class 239 properties untaxable_value_eav = ifelse (class == 239 , - taxed_eav, untaxable_value_eav), untaxable_value_av = untaxable_value_eav / eq_factor,untaxable_value_fmv = untaxable_value_av / loa,exempt_fmv = exempt_eav / eq_factor / loa, fmv_inTIF = ifelse (in_tif== 1 , av/ loa, 0 ),fmv_tif_increment = ifelse (final_tax_to_tif > 0 , / (tax_code_rate/ 100 )) / eq_factor ) / loa, 0 ),fmv_incents_inTIF = ifelse (between (class, 600 , 899 ) & in_tif == 1 , 0 ),fmv_incents_tif_increment = ifelse (between (class, 600 , 899 ) & final_tax_to_tif > 0 , / (tax_code_rate/ 100 )) / eq_factor ) / loa, 0 ),naive_rev_forgone = untaxable_incent_eav * tax_code_rate/ 100 ) %>% select (tax_code, class, pin, fmv,everything ())``` ```{r} #| label: create-muni_ratechange-csv #| eval: false <- ptax_pins %>% mutate (class = as.numeric (class)) %>% # Allows for joining later select (- c (propclass_1dig: av.y)) %>% filter (! clean_name %in% c ("Frankfort" , "Homer Glen" , "Oak Brook" , "East Dundee" , "University Park" , "Bensenville" , "Hinsdale" , "Roselle" , "Deer Park" , "Deerfield" )) %>% # filter(!agency_num %in% cross_county_lines) %>% group_by (clean_name) %>% summarize (classgroup_PC = n (),# projects = n_distinct(both_ids), # mostly for industrial and commercial properties pins_withincents = sum (ifelse (class >= 600 & class < 900 , 1 ,0 )),fmv_incentive = sum (ifelse (class >= 600 & class < 900 , fmv, 0 ), na.rm = TRUE ),#fmv_taxed = sum(taxed_fmv, na.rm=TRUE), fmv_incents_inTIFs = sum (ifelse (class >= 600 & class < 900 & final_tax_to_tif > 0 , fmv, 0 ), na.rm = TRUE ),fmv_inTIF = sum (ifelse (final_tax_to_tif > 0 , fmv, 0 ), na.rm= TRUE ),fmv_tif_increment = sum (fmv_tif_increment, na.rm= TRUE ),fmv_untaxable_value = sum (untaxable_value_fmv , na.rm= TRUE ),fmv_exemptions = sum (all_exemptions/ eq_factor/ loa, na.rm= TRUE ),fmv_abatements = sum (exe_abate/ eq_factor/ loa, na.rm= TRUE ),zero_bill = sum (zero_bill, na.rm= TRUE ),fmv_residential = sum (ifelse (class %in% c (200 : 399 ), fmv, 0 ), na.rm = TRUE ),fmv_C2 = sum (ifelse (class %in% c (200 : 299 ), fmv, 0 ), na.rm = TRUE ),fmv_industrial = sum (ifelse (class %in% industrial_classes, fmv, 0 ), na.rm = TRUE ),fmv_commercial = sum (ifelse (class %in% commercial_classes, fmv, 0 ), na.rm = TRUE ),current_rate_avg = mean (tax_code_rate),avg_C2_bill_noexe = mean (ifelse (between (class,200 ,299 ) & all_exemptions == 0 , (final_tax_to_dist + final_tax_to_tif), NA ), na.rm= TRUE ),avg_C2_bill_withexe = mean (ifelse (between (class,200 ,299 ) & all_exemptions > 0 , (final_tax_to_dist + final_tax_to_tif), NA ), na.rm= TRUE ),av_taxed = sum (taxed_av, na.rm = TRUE ),untaxable_value_av = sum (untaxable_value_av, na.rm= TRUE ),av = sum (av),eav_taxed = sum (taxed_av* eq_factor), eav_untaxable = sum (untaxable_value_eav, na.rm= TRUE ),eav_tif_increment = sum (final_tax_to_tif/ tax_code_rate, na.rm= TRUE ),eav_max = sum (fmv* loa* eq_factor, na.rm= TRUE ),fmv = sum (fmv, na.rm= TRUE ),pins_in_class = n (),all_exemptions = sum (all_exemptions), # in EAV abatements = sum (exe_abate), # in EAV eav_incents_inTIFs = sum (ifelse (class >= 600 & class <= 900 & in_tif == 1 , eav, 0 ), na.rm = TRUE ),final_tax_to_dist = sum (final_tax_to_dist),final_tax_to_tif = sum (final_tax_to_tif),eav = sum (eav),new_TEAV_noIncents = sum (ifelse (class >= 600 & class < 900 ,* eq_factor/ loa)* 0.25 , taxed_av* eq_factor), na.rm= TRUE ),####### Not used currently # new_TEAV_noC6 = sum(ifelse( class >=600 & class <700, # (taxed_av*eq_factor/loa)*0.25 , taxed_av*eq_factor)), # new_TEAV_noC7 = sum(ifelse(class >=700 & class <800, # (taxed_av*eq_factor/loa)*0.25, taxed_av*eq_factor)), # new_TEAV_noC8 = sum(ifelse(class >=800 & class <900, (taxed_av*eq_factor/loa)*0.25, taxed_av*eq_factor)), # ####### new_TEAV_vacant_noIncents = sum (ifelse (class >= 600 & class < 900 ,0 , taxed_av* eq_factor))%>% mutate (new_TEAV_noExemps = eav_taxed + all_exemptions, # does not include abatements new_TEAV_noAbates = eav_taxed + abatements, # include only abatements, not other exemption types # amount of EAV from taxing an additional 15% of the AV if incentive properties didn't exist forgone_EAV_incent = #class_group %in% incentive_majorclasses, #incent_prop == "Incentive", - eav_taxed) %>% #cbind(table_cook) %>% mutate (# Absolute maximum TEAV: No Exemptions, no abatements, no TIFS, no Incentive properties # Commercial and industrial assessed at 25% TEAV_max = eav_taxed + all_exemptions + abatements + eav_tif_increment + forgone_EAV_incent,# no exemptions or incentive classifications: TEAV_neither = eav_taxed + all_exemptions + forgone_EAV_incent,rate_noExe = final_tax_to_dist / new_TEAV_noExemps * 100 ,rate_noAbate = final_tax_to_dist / new_TEAV_noAbates * 100 ,rate_noInc = final_tax_to_dist / new_TEAV_noIncents * 100 ,rate_neither = final_tax_to_dist / TEAV_neither * 100 , rate_noTIFs = final_tax_to_dist / (eav_taxed + eav_tif_increment) * 100 ,rate_vacant = final_tax_to_dist / new_TEAV_vacant_noIncents* 100 ,rate_lowest = final_tax_to_dist / TEAV_max * 100 ,# rate_noC6 = levy / new_TEAV_noC6 * 100, # rate_noC7 = levy / TEAV_noC7 * 100, # rate_noC8 = levy / TEAV_noC8 * 100, rate_current = final_tax_to_dist / eav_taxed * 100 ,change_noInc = rate_current - rate_noInc,change_neither = rate_current - rate_neither,change_noTIF = rate_current - rate_noTIFs,change_noExe = rate_current - rate_noExe,change_vacant = rate_current - rate_vacant,change_lowest = rate_current - rate_lowest%>% mutate (across (contains ("rate_" ), round, digits = 2 )) %>% mutate (across (contains ("change_" ), round, digits = 2 ))write_csv (muni_ratechange, "../Output/muni_ratechange_2023.csv" )``` ```{r readin-muniratechange} muni_ratechange <- read_csv("../Output/muni_ratechange_2023.csv") muni_ratechange %>% select(clean_name, starts_with("change_")) %>% DT::datatable(rownames = FALSE) ``` ### Figure 6. Composite property tax rates with and without homestead exemptions, tax year 2021 ### Table 1. Change in composite property tax rates due to exemptions, tax year 2023. ```{r} #| label: tbl-table1-datatable #| tbl-cap: "Searchable table containing all municipalities and the hypothetical tax rate change if exempt EAV became taxable." %>% select (clean_name, current_rate_avg, rate_noExe, change_noExe, final_tax_to_dist %>% :: datatable (rownames = FALSE , colnames = c ('Municipality' = 'clean_name' ,'Current Comp. Rate' = 'current_rate_avg' , 'Hypothetical Rate' = 'rate_noExe' , 'Composite Tax Rate Change' = 'change_noExe' , 'Composite Levy' = 'final_tax_to_dist' ),caption = "Table 1: Current and Hypothetical Composite Tax Rates if GHE $0" ) %>% formatCurrency ('Composite Levy' , digits = 0 )``` ```{r} #| label: tbl-Table1-sliced #| tbl-cap: "Includes all exemption types in calculation of rate change." %>% select (clean_name, current_rate_avg, rate_noExe, change_noExe %>% arrange (desc (change_noExe)) %>% slice (c (1 : 5 , 69 : 73 , 121 : 125 )) %>% #slice(c(1:5, 58:62, 115:119)) %>% flextable () %>% border_remove () %>% hline_top () %>% hline (i = c (5 ,10 )) %>% set_header_labels (clean_name = "Municipality" , current_rate_avg = "With Exemptions" ,rate_noExe = "Without Exemptions" ,change_noExe = "Percent Point Difference" %>% align (j = 2 , align = "right" ) %>% align (j= 2 , align = "right" , part = "header" ) %>% set_table_properties ( layout = "autofit" ) %>% bold (i = 8 ) ``` ### Figure 7. Map of Spatial Patterns in Composite Tax Rate Change ```{r} %>% left_join (nicknames, by = "clean_name" ) %>% #mutate(burden_current = ifelse(burden_current>1, 1, burden_current)) %>% # filter(major_class_code == 2) %>% mutate (agency_name = ifelse (agency_name == "TOWN CICERO" , "CITY OF CICERO" , agency_name),shpfile_name = ifelse (agency_name == "TOWN CICERO" , "CITY OF CICERO" , agency_name) ) %>% full_join (muni_shp, by = c ("agency_name" = "AGENCY_DESC" )) %>% ggplot (aes (fill = change_noExe)) + geom_sf (aes (geometry = geometry), color = "black" ) + theme_void () + theme (axis.ticks = element_blank (), axis.text = element_blank ())+ scale_fill_stepsn (colors = c ( "#F7FEF5" ,# "#e4f1e0", "#d4f6cc" ,"#47ba24" ,"#1F6805" ,"#133C04" ),show.limits= TRUE , limits = c (0 , 15 ),breaks = c (0 , 2.5 , 5 , 7.5 , 10 , 15 ),na.value = NA ,name = "Rate Change from \n Exemptions" ``` ## Effect on Tax Burdens ### Figure 8. Dolton example of Share of levy paid by property type ```{r tbl-figure8} taxcodes_current <- ptax_pins %>% group_by(tax_code) %>% summarize( av = sum(av), eav = sum(eav), equalized_AV = sum(equalized_av), pins_in_class = n(), current_exemptions = sum(all_exemptions), HO_exemps = sum(exe_homeowner), tax_code_rate = first(tax_code_rate), final_tax_to_dist = sum(final_tax_to_dist, na.rm = TRUE), # used as LEVY amount!! final_tax_to_tif = sum(final_tax_to_tif, na.rm = TRUE), tax_amt_exe = sum(tax_amt_exe, na.rm = TRUE), tax_amt_pre_exe = sum(tax_amt_pre_exe, na.rm = TRUE), tax_amt_post_exe = sum(tax_amt_post_exe, na.rm = TRUE), rpm_tif_to_cps = sum(rpm_tif_to_cps, na.rm = TRUE), # not used rpm_tif_to_rpm = sum(rpm_tif_to_rpm, na.rm=TRUE), # not used rpm_tif_to_dist = sum(rpm_tif_to_dist, na.rm=TRUE), # not used tif_share = mean(tif_share, na.rm=TRUE), # not used ) %>% mutate(total_bill_current = final_tax_to_dist + final_tax_to_tif) %>% mutate(cur_comp_TC_rate = tax_code_rate) %>% mutate(current_taxable_eav = final_tax_to_dist/(cur_comp_TC_rate/100), new_taxable_eav = final_tax_to_dist/(cur_comp_TC_rate/100) + HO_exemps) %>% mutate(new_comp_TC_rate = (final_tax_to_dist / new_taxable_eav)*100) %>% mutate(new_comp_TC_rate = ifelse(is.nan(new_comp_TC_rate), cur_comp_TC_rate, new_comp_TC_rate)) %>% select(tax_code, cur_comp_TC_rate, new_comp_TC_rate, current_taxable_eav, new_taxable_eav, everything()) taxcode_taxrates <- taxcodes_current %>% select(tax_code, cur_comp_TC_rate, new_comp_TC_rate, current_exemptions, HO_exemps) mc_burden <- ptax_pins |> left_join(taxcode_taxrates, by = "tax_code") |> group_by(clean_name, class_1dig) |> ## calculate taxbase from each major class ## and the amount of taxes currently collected from each summarize(group_taxbase= sum(taxed_eav), group_taxes_current = sum(taxed_eav * (tax_code_rate/100)), hyp_group_taxbase = sum(taxed_eav + all_exemptions, na.rm = T), hyp_group_taxes = sum( (taxed_eav + all_exemptions) * (new_comp_TC_rate/100), na.rm = T) ) %>% mutate(across(c(group_taxbase:hyp_group_taxes), round, 0)) %>% group_by(clean_name) |> mutate( muni_taxbase = sum(group_taxbase, na.rm=T), muni_levy = sum(group_taxes_current, na.rm = T) ) %>% ungroup() %>% mutate( pct_eav = group_taxbase / muni_taxbase, pct_taxburden_current = group_taxes_current / muni_levy, hyp_pct_taxburden = hyp_group_taxes / muni_levy) |> mutate( burden_shift = (pct_taxburden_current - hyp_pct_taxburden)*100) burden_c2 <- mc_burden %>% filter(class_1dig == 2) %>% select(clean_name, pct_eav, burden_shift, pct_taxburden_current, hyp_pct_taxburden) %>% arrange(pct_eav) mc_burden %>% filter(clean_name == "Dolton") %>% select(class_1dig, pct_taxburden_current, hyp_pct_taxburden) %>% arrange(desc(pct_taxburden_current)) ``` ### Figure 9. Change in Share of Tax Burden ### Table 2. Change in share of property tax burden ```{r} #| eval: FALSE #| label: attemptfor-burdenshift <- ptax_pins %>% mutate (Group = case_when (== 2 ~ "Single-family" ,%in% c (3 , 9 ) ~ "Multi-family" ,TRUE ~ "Commercial & Industrial" %>% left_join (taxcode_taxrates, by = "tax_code" ) |> group_by (clean_name, Group) |> ## calculate taxbase from each major class ## and the amount of taxes currently collected from each summarize (group_taxbase= sum (taxed_eav, na.rm = T),group_taxes_current = sum (taxed_eav * (tax_code_rate/ 100 ), na.rm = T),hyp_group_taxbase = sum (taxed_eav + all_exemptions, na.rm = T),hyp_group_taxes = sum ( (taxed_eav + all_exemptions) * (new_comp_TC_rate/ 100 ), na.rm = T)%>% mutate (across (c (group_taxbase: hyp_group_taxes), round, 0 )) %>% ungroup () |> group_by (clean_name) |> mutate (muni_taxbase = sum (group_taxbase, na.rm= T),muni_levy = sum (group_taxes_current, na.rm = T)%>% ungroup () %>% mutate (pct_eav_current = group_taxbase / muni_taxbase,pct_taxburden_current = group_taxes_current / muni_levy,hyp_pct_taxburden = hyp_group_taxes / muni_levy) |> mutate (burden_shift = (pct_taxburden_current - hyp_pct_taxburden)* 100 ) ``` ```{r} <- ptax_pins %>% filter (class_1dig != 0 ) |> mutate (Group = case_when (== 2 ~ "Single-family" ,== 3 | class_1dig == 9 ~ "Multi-family" ,TRUE ~ "Commercial & Industrial" %>% left_join (taxcode_taxrates, by = "tax_code" ) |> group_by (clean_name) %>% mutate (muni_levy = sum (final_tax_to_dist, na.rm= TRUE )) %>% ungroup () %>% group_by (clean_name, Group, muni_levy) |> ## calculate taxbase from each major class ## and the amount of taxes currently collected from each summarize (group_taxbase= sum (taxed_eav, na.rm = T),group_taxes_current = sum (taxed_eav * (cur_comp_TC_rate/ 100 ), na.rm = T),hyp_group_taxbase = sum (taxed_eav + all_exemptions, na.rm = T),hyp_group_taxes = sum ( (taxed_eav + all_exemptions) * (new_comp_TC_rate/ 100 ), na.rm = T)) %>% mutate (across (c (group_taxbase: hyp_group_taxes), round, 0 )) %>% ungroup () |> # group_by(clean_name) |> # mutate( # muni_taxbase = sum(group_taxbase, na.rm=T), # muni_levy = sum(group_taxes_current, na.rm = T) # ) %>% # ungroup() %>% mutate (# pct_eav_current = group_taxbase / muni_taxbase, pct_taxburden_current = group_taxes_current / muni_levy,hyp_pct_taxburden = hyp_group_taxes / muni_levy) |> mutate (burden_shift = (pct_taxburden_current - hyp_pct_taxburden))``` ```{r} #| label: tbl-currenttaxburden #| tbl-cap: "Current tax burden (levy paid by group / total levy billed by municipality)" ## Current tax burden %>% select (clean_name, Group, pct_taxburden_current) %>% pivot_wider (id_cols = clean_name, names_from = Group, values_from = pct_taxburden_current) %>% arrange ((` Single-family ` ))``` > Something is wrong with burden shift calculation ```{r} #| label: tbl-burden_change #| tbl-cap: "Change in tax burden, measured in percentage point change." %>% select (clean_name, Group, burden_shift) %>% pivot_wider (id_cols= clean_name, names_from = Group, values_from = burden_shift) %>% arrange ((` Single-family ` ))``` ```{r} #| code-fold: true #| eval: false datatable (burden_c2, rownames = FALSE ,colnames = c ('Municipality' = 'clean_name' , 'Burden Shift, Pct Pt Change' = 'burden_shift' , "C2 EAV/Muni EAV" = 'pct_eav' , 'Current Tax Burden \n C2 Tax Collected / Muni Levy' = 'pct_taxburden_current' , "Hypothetical Tax Burden \n Hyp. C2 Tax Collected / Muni Levy" = 'hyp_pct_taxburden' ),caption = "Table 2: Current Share of Taxable EAV and Share of Levy Paid by Class 2 Properties" %>% formatPercentage (c (2 ,3 ,4 ,5 ), digits = 2 ) %>% formatRound (c (3 ), digits = 2 )``` #### Figure 9 Follow up. Current Tax Burden Map ```{r} %>% left_join (nicknames) %>% mutate (agency_name = ifelse (agency_name == "TOWN CICERO" , "CITY OF CICERO" , agency_name) ) %>% full_join (muni_shp, by = c ("agency_name" = "AGENCY_DESC" )) %>% ggplot (aes (fill = pct_taxburden_current)) + geom_sf (aes (geometry = geometry), color = "black" ) + theme_void () + theme (axis.ticks = element_blank (), axis.text = element_blank ())+ # scale_fill_gradientn( scale_fill_stepsn (colors = c ("#ffffcc" ,"#a1dab4" ,"#41b6c4" ,"#2c7fb8" , "#253494" ),show.limits= TRUE , limits = c (0 ,1 ),na.value = "gray70" ,n.breaks = 6 ,name = "Burden with \n Exemptions" , labels = scales:: percent+ labs (title = "Current share of property tax burden" , subtitle = "for Class = 2 Property Types" )``` ### Table 3. <!---Used Cholton Taxbills file originally when making this. use ptax_pins, filter out munis we want that are major class 2, with assessed values of $15K ----> ```{r} <- ptax_pins %>% left_join (taxcode_taxrates, by = "tax_code" ) |> mutate (bill_current = (final_tax_to_dist + final_tax_to_tif),bill_noGHE = new_comp_TC_rate/ 100 * (equalized_av- all_exemptions+ exe_homeowner),bill_noexemps = new_comp_TC_rate/ 100 * (equalized_av),bill_change = bill_noGHE - bill_current)``` ```{r} <- ptax_pins %>% filter (class > 199 & class < 300 ) %>% group_by (clean_name) %>% arrange (av) %>% summarize (median_eav = round (median (eav)), median_av = round (median (av)), avg_av = round (mean (av)),avg_eav = round (mean (eav)),C2_pins_in_muni = n (),C2_current_exemptions = sum (all_exemptions, na.rm = TRUE ),C2_HO_exemps = sum (exe_homeowner, na.rm = TRUE ),## removes properties that have more than one exemption type <- ptax_pins %>% filter (class > 199 & class < 300 ) %>% filter (exe_senior == 0 & == 0 & == 0 & == 0 & == 0 & == 0 & == 0 & == 0 & == 0 ) %>% group_by (clean_name) %>% arrange (av) %>% summarize (median_eav = round (median (eav, na.rm= TRUE )), median_av = round (median (av, na.rm= TRUE )), avg_av = round (mean (av, na.rm= TRUE )),avg_eav = round (mean (eav, na.rm= TRUE )),C2_pins_in_muni = n (),C2_current_exemptions = sum (all_exemptions, na.rm = TRUE ),C2_HO_exemps = sum (exe_homeowner, na.rm = TRUE ),``` ```{r} ## Grouped by if they have a $0 tax bill and had the GHE per muni ## Recalculating for Josh & Rachael <- ptax_pins %>% filter (class > 199 & class < 300 ) %>% # merge in muni residential median AV left_join (C2_munistats_filtered) %>% # +/- 500 from municpalities median residential AV filter (av < median_av+ 200 & av > median_av-200 ) %>% # Removes properties that received other types of exemptions filter (exe_senior == 0 & == 0 & == 0 & == 0 & == 0 & == 0 & == 0 & == 0 & == 0 ) %>% arrange (av) %>% mutate (bill_current = (final_tax_to_dist + final_tax_to_tif),bill_noexemps = new_comp_TC_rate/ 100 * (equalized_av- all_exemptions+ exe_homeowner),bill_change = bill_noexemps - bill_current) %>% group_by (clean_name, # zero_bill, %>% summarize (AV = median (median_av), # median_av was calculated earlier: C2 median AV for the muni ` Taxable EAV ` = round (median (eav)),bill_cur = round (median (bill_current)),bill_new = round (median (bill_noexemps)),bill_change = round (median (bill_change)),pincount= n (),perceived_savings = round (median (tax_amt_exe))) %>% # merge in clean_names variable left_join (nicknames) %>% select (clean_name, has_HO_exemp, bill_cur, bill_new, bill_change, perceived_savings, AV, ` Taxable EAV ` , everything ()) %>% select (- c (agency_number, agency_name))<- ptax_pins %>% group_by (clean_name) %>% arrange (av) %>% summarize (muni_median_av = round (median (av, na.rm= TRUE )),muni_median_eav = round (median (eav, na.rm= TRUE )),muni_mean_av = round (mean (av, na.rm= TRUE )),muni_mean_eav = round (mean (eav, na.rm= TRUE )),av = sum (av, na.rm = TRUE ),eav = sum (eav, na.rm = TRUE ),equalized_AV = sum (equalized_av, na.rm = TRUE ),pins_in_muni = n (),current_exemptions = sum (all_exemptions, na.rm = TRUE ),HO_exemps = sum (exe_homeowner, na.rm = TRUE ),tax_code_rate = mean (tax_code_rate, na.rm = TRUE ), # Changed from first() to mean() on Nov 1 final_tax_to_dist = sum (final_tax_to_dist, na.rm = TRUE ), # used as LEVY amount!! final_tax_to_tif = sum (final_tax_to_tif, na.rm = TRUE ),tax_amt_exe = sum (tax_amt_exe, na.rm = TRUE ), tax_amt_pre_exe = sum (tax_amt_pre_exe, na.rm = TRUE ), tax_amt_post_exe = sum (tax_amt_post_exe, na.rm = TRUE ),rpm_tif_to_cps = sum (rpm_tif_to_cps, na.rm = TRUE ), # not used rpm_tif_to_rpm = sum (rpm_tif_to_rpm, na.rm= TRUE ), # not used rpm_tif_to_dist = sum (rpm_tif_to_dist, na.rm= TRUE ), # not used tif_share = mean (tif_share, na.rm= TRUE ), # not used %>% mutate (total_bill_current = final_tax_to_dist + final_tax_to_tif) %>% rename (cur_comp_TC_rate = tax_code_rate) %>% mutate (current_taxable_eav = final_tax_to_dist/ (cur_comp_TC_rate/ 100 ),new_taxable_eav = final_tax_to_dist/ (cur_comp_TC_rate/ 100 ) + HO_exemps) %>% mutate (new_comp_TC_rate = (final_tax_to_dist / new_taxable_eav)* 100 ) %>% mutate (new_comp_TC_rate = ifelse (is.nan (new_comp_TC_rate), cur_comp_TC_rate, new_comp_TC_rate)) %>% left_join (C2_munistats) %>% left_join (nicknames) %>% mutate (rate_change = cur_comp_TC_rate - new_comp_TC_rate,nobillchange_propertyEAV = round (10000 * ((cur_comp_TC_rate/ 100 ) / (rate_change/ 100 ))),nochange_av = round (nobillchange_propertyEAV / eq_factor),nochange_ratio = nochange_av / median_av) %>% select (clean_name, C2median_av = median_av, muni_median_av, C2mean_av = avg_av, muni_mean_av, cur_comp_TC_rate, new_comp_TC_rate, current_taxable_eav, new_taxable_eav, everything ())%>% left_join (nicknames) %>% select (clean_name, muni_median_av, C2median_av, nochange_av )%>% left_join (muni_taxrates) %>% ungroup () %>% select (clean_name, has_HO_exemp, bill_cur, bill_new, bill_change, perceived_savings, AV, ` Taxable EAV ` , nochange_av, nochange_ratio) #%>% ``` ```{r} |> filter (clean_name %in% c ("Chicago" , "Dolton" , "Glencoe" )) |> filter (between (av, 14500 , 15000 )) %>% filter (class_1dig == 2 ) |> filter (exe_senior == 0 & exe_freeze == 0 ) |> group_by (clean_name, has_HO_exemp) %>% arrange (av) %>% summarize (median_bill = median (total_billed, na.rm= TRUE ),median_AV = median (av, na.rm= TRUE ),eav = median (eav, na.rm= TRUE ),# class = median(class), type = "Current Exemptions" ,N = n ())``` ### Table 4. ### Figure 10. Tax Burden Shift from Current GHE  ```{r} #| label: fig-dotplotburdenshift # as a dot graph ## <- mc_burden |> filter (class_1dig == 2 ) |> select (clean_name, pct_taxburden_current, burden_shift)<- mc_burden |> filter (class_1dig == 2 ) |> select (clean_name, pct_taxburden_current, burden_shift) %>% arrange (pct_taxburden_current) %>% slice (1 : 5 , 63 : 67 , 127 : 131 )<- median (order$ pct_taxburden_current)<- median (order$ burden_shift)# median burden change is 5.9 percentage points # current median burden is 70.3% of the levy %>% filter (clean_name %in% slice$ clean_name) %>% #filter(!clean_name %in% cross_county_lines$clean_name)%>% filter (class_1dig == 2 ) |> # filter(burden_current > 0.938 |burden_current < .17 | # ( (burden_current < median(burden_current) + 0.01 )& (burden_current > median(burden_current) - 0.01)) )%>% ungroup () %>% select (clean_name, pct_taxburden_current, hyp_pct_taxburden, burden_shift) %>% arrange (burden_shift) %>% # mutate( burden_noexemps = ifelse(burden_noexemps > 1, 1, burden_noexemps)) %>% pivot_longer (c ("pct_taxburden_current" , "hyp_pct_taxburden" ), names_to = "type" , values_to = "pct_burden" ) %>% inner_join (order) %>% ggplot (aes (x = pct_burden* 100 , y= reorder (clean_name, - pct_taxburden_current)))+ # y= reorder(clean_name, burden_current)))+ geom_vline (xintercept = 70.2 , linetype = 3 )+ geom_line (aes (group = clean_name))+ geom_hline (yintercept = 5.5 , linetype = 2 )+ geom_hline (yintercept = 10.5 , linetype = 2 )+ geom_point (aes (color= type), size= 3 )+ theme_minimal () + theme (#legend.position = "none", legend.title = element_blank (),plot.title.position = "plot" ,# panel.background = element_rect(fill='transparent'), #transparent panel bg plot.background = element_rect (fill= 'transparent' , color= NA ) #transparent plot bg + scale_color_brewer (palette= "Paired" , labels = c ("Current Burden" , "Burden if \n No Exemptions" ), direction = 1 )+ labs (title = "Change in Class 2 Residential Tax Burden" , subtitle = "Ordered by Current Tax Burden" ,x = "Share of Levy (%)" , y = "" , caption = "Dotted line represents median Class 2 burden (65.5% of the levy). Residential Tax Burden is the share of the property tax collected that was paid for by property owners with Class 2 properties." ) + geom_label (label = "Class 2 pays small share of \n levy; very little residential" , x= 32 , y = 13 , label.size = 1 , size = 3 )+ geom_label (label = "Class 2 pays median share of \n levy (70.3%), mix of land use" , x= 42 , y = 7.5 , label.size = 1 , size = 3 ) + geom_label (label = "Class 2 pays nearly all of levy, \n highly residential" , x= 70 , y = 3 , label.size = 1 ,size = 3 )``` ### Figure 11. Zero Dollar Bills ```{r} %>% filter (major_class_code == 2 ) %>% group_by (year) %>% summarize (zerodollar_count = sum (zero_bill)) %>% ggplot (aes (x= year, y = zerodollar_count)) + geom_bar (position = "stack" , stat = "identity" ) + theme_minimal ()``` ```{r} <- ptax_pins |> filter (class_1dig == 2 & eav < 150 ) |> select (clean_name, class, eav, equalized_av, av, fmv, total_billed, everything ()) |> arrange (total_billed) %>% arrange (desc (total_billed)) %>% filter (total_billed > 0 )|> summarize (n = n (), exe_freeze = sum (exe_freeze, na.rm= T),exe_senior = sum (exe_senior, na.rm= T),exe_homeowner = sum (exe_homeowner, na.rm= T))|> group_by (clean_name) %>% summarize (n = n (), exe_freeze = sum (exe_freeze, na.rm= T),exe_senior = sum (exe_senior, na.rm= T),exe_homeowner = sum (exe_homeowner, na.rm= T))|> select (clean_name, class, eav, equalized_av, av, fmv, ``` ```{r} <- ptax_pins |> filter (class_1dig == 2 & eav > 0 & total_billed == 0 ) |> select (clean_name, class, eav, equalized_av, av, fmv, total_billed, final_tax_to_dist, pin, exe_homeowner, exe_senior, exe_freeze, everything ()) %>% arrange (desc (exe_freeze))options (scipen = 999 )%>% reframe (n = n (), total_eav = sum (taxed_eav + exempt_eav, na.rm= TRUE ),exe_homeowner = sum (exe_homeowner), exe_senior = sum (exe_senior), exe_freeze = sum (exe_freeze), taxed_eav = sum (taxed_eav, na.rm= TRUE ), .by = clean_name) |> arrange (desc (exe_freeze))%>% summarize (n = n (), total_eav = sum (taxed_eav + exempt_eav, na.rm= TRUE ),exe_homeowner = sum (exe_homeowner), exe_senior = sum (exe_senior), exe_freeze = sum (exe_freeze), taxed_eav = sum (taxed_eav, na.rm= TRUE )) |> arrange (desc (exe_freeze))%>% group_by (Triad) %>% summarize (n = n (), total_eav = sum (taxed_eav + exempt_eav, na.rm= TRUE ),exe_homeowner = sum (exe_homeowner), exe_senior = sum (exe_senior), exe_freeze = sum (exe_freeze), taxed_eav = sum (taxed_eav, na.rm= TRUE )) |> arrange (desc (exe_freeze))``` ```{r} |> filter (class_1dig == 2 & eav > 0 & total_billed == 0 ) |> select (clean_name, class, eav, equalized_av, av, fmv, total_billed, final_tax_to_dist, pin, exe_homeowner, exe_senior, exe_freeze) %>% arrange (desc (exe_freeze)) %>% summarize (max = max (eav),min = min (eav),median = median (eav),n = n ()) ```